As a leading and independent full service provider for testing and certification of SmartCard, RFID and NFC related solutions, cetecom advanced’s worldwide operating division for SmartCard Technologies with laboratories in Saarbrucken (Germany) and Anyang (Korea) offers a wide range of debug and type approval services for banking and finance solutions as well as eIdentification, eHealth, eTicketing and Biometrics for cards and mobile. We provide our customers with extensive support related to SmartCard testing services and similar solutions for multiple industries and applications.

SmartCards are becoming increasingly important in the health sector. They facilitate the administration of patient data and accounting for medical services rendered. Because they are easy to use, they also contribute to cushioning the cost explosion that is taking place in the health sector.

cetecom advanced also offers testing service for Gesundheitskarte terminals and connectors.

cetecom advanced is the only testing body worldwide recognized by the BSI (Bundesamt für Sicherheit in der Informationstechnik / German Federal Office for Information Security) for the testing of the RF-interface of electronic travel documents.

In our BSI recognized laboratory, we test electronic travel documents (passports and national ID cards) as well as the different development stages of these products (chips, inlays, etc.) according to national and international requirements. These services are also available for the corresponding reader devices. In addition, we support you in the handling of application formalities and the accomplishment of the certification procedure with the referring national certification authorities.

In addition to the BSI standards mentioned above, we offer test services according to the following specifications:

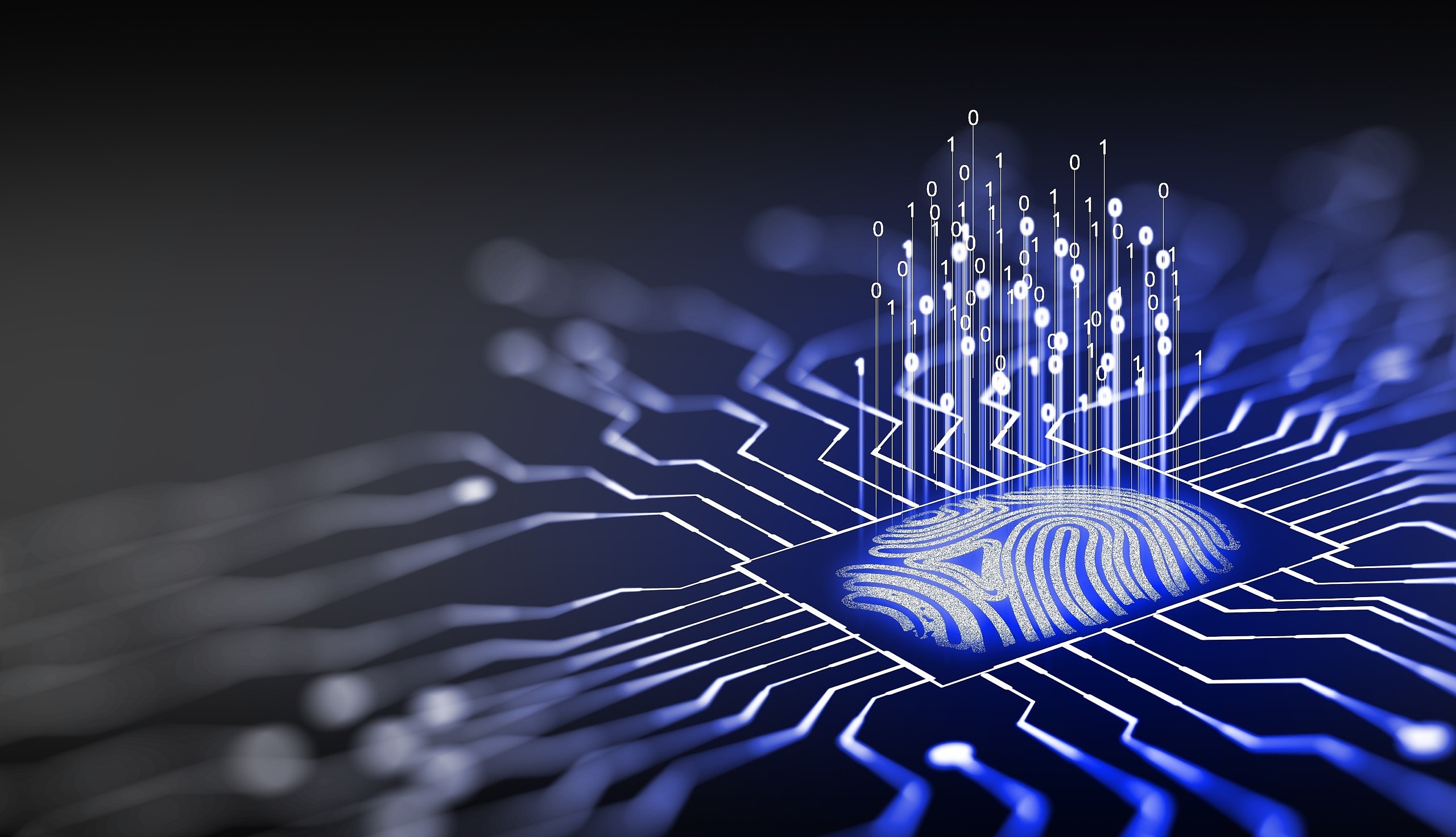

Latest market data show that Biometric cards with fingerprint are accepted by consumers. The technology of Biometric fingerprint authentication makes payment easier and more secure, both in retail and in digital commerce (eCommerce). In particular, the increased security during payment transactions with the intensively tested fingerprint sensors and the sophisticated software algorithms is seen as a massive step towards fraud protection.

The current sensors are mature and can be used because years of experience in the field of identity documents (passport, ID card) can be drawn on here. The international standards for fingerprint technology (NIST, ISO, FIDO) are also taken into account for the new payment cards.

As a test laboratory, cetecom advanced has been involved with this new technology from the very beginning and got the accreditiations from Mastercard and Visa. Additional accreditations will follow.

Additionally, cetecom advanced is accredited and listed as Google corporation partner for Biometric Security Testing meeting Android’s requirements for fingerprint testing and face recognition.

The high acceptance of the Biometric payment card, which is of course contactless, has been accelerated by the developments of the Covid-19 Pandemic and has proven to be durable. Consumer confidence in card payments is thus increased for both the customer and the retailer (point of acceptance).

Quality assurance is a key step in the process of creating a certifiable Biometric identification or payment product. To optimize and guarantee high quality, cetecom advanced offers additional services for manufacturers and issuers of a fingerprint-based Biometric product to optimize the products during the different development stages:

Near Field Communication (NFC) is an extension of the existing SmartCard standards (contactless/RFID) that combines the interface of a SmartCard and a reader into a single device.

Our Lab offers different test services for NFC devices:

Whether RFID technology is used for ePassport, Contactless or NFC applications, cetecom advanced supports customers in setting and evolving the performance, ensuring that products meet the expectations for regulatory, quality, health, environmental and safety standards for almost any market around the world.

In Germany VDV eTicket Service GmbH & Co. KG (VDV-ETS) is responsible for the development of the VDV Core Application, the German standard of electronic fare management. To ensure interoperability, all eTicket applications must comply with this standard.

cetecom advanced has been designated by VDV-ETS, who manages the standard and offers services for system support, as the official test lab for conducting the related certification tests to make sure that all eTicketing systems are in compliance with the VDV Core Application.

To ensure proper implementation of all involved systems at a maximum reliability and security level all terminal types, background systems, SAMs and SmartCards will be tested following the VDV Core Application specifications. The referring test tools are provided by UL Transaction Security, well-known for its expertise in the field of test tool development.

cetecom advanced’s eTicket test spectrum following VDV Core Application comprise:

Requirement for qualification testing is physical testing and inspection of the Device under Test (DUT). cetecom advanced conducts this testing and inspection for the customers.

Our development team handles individual testing solutions for our own usage. At this, the competence of our networked team members reaches from software engineers over hardware specialists to mechanical engineers. With our way of interdisciplinary work and our infrastructure for fast and flexible solutions, we have created our own competence center.

We offer our own testing solutions for challenging applications also to our customers. In addition to existing solutions, we offer individual development within the area of our core competence, testing and certification. The scope of development projects can contain everything from technical support up to turnkey ready solutions. As a laboratory, we are close to our own products and understand the needs of our customers quite well. After a comprehensive needs analysis, we create a plan with test solutions that fit your individual needs. Let us introduce our expertise and some of the solutions we offer.

Over the last 10 years, we were able to gain experience in a wide area:

Besides our own testing solutions, we were able to satisfy our customer requirements by individual solutions:

Michael Türnau

Account Manager

michael.tuernau@cetecomadvanced.com

+49 681 598-8120

Bernhard Mommenthal

Account Manager

bernhard.mommenthal@cetecomadvanced.com

+49 681 598-8190

Takaya Osaki

Head of Smartpayment Japan

sct.japan@cetecom.com

+81 45 594 9155

Allen Kim

Team Manager SmartCard Korea

allen.kim@cetecomadvanced.com

+82 70 4710 9581

Terminals

Cards / Wearables

Mobile

3-D Secure

Terminals

Cards / Wearables

Mobile

Biometric Product Testing

Acceptance Devices/Terminals

Cards / Wearables

Mobile

Formal Approval Service Provider

Biometric Product Testing – Sensor & Algorithm

Terminals

Cards / Wearables

Mobile

Terminals

Cards / Wearables

Mobile

Terminals

Terminals

Accreditations for

cetecom advanced Test Tool

cetecom advanced is approved by the BSI to perform the following smart card test services:

cetecom advanced is worldwide the only BSI-approved test laboratory for the testing of the RF interface of electronic travel documents.

.

cetecom advanced has been designated by VDV-ETS as an official test laboratory

and is accredited to perform the following test services:

Biometric Product Testing

cetecom advanced is an ATL (Authorized Test Laboratory) for Digital Key (DK Applet Compliance and End-to-End Interoperability)